January 2020 Market Update

Let’s jump straight into the good stuff hey?!

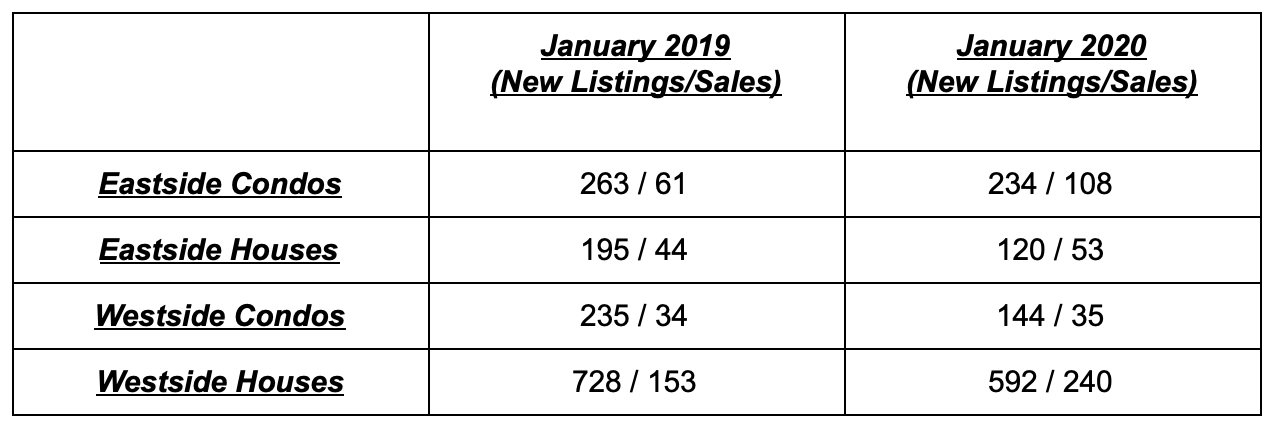

Above are the January 2019 vs January 2020 numbers when discussing ‘New Listings’ to the market and number of recorded ‘Sales’. These are specific to Vancouver’s East and West side mind you, however we have some additional holistic comparisons below as well in the hopes to show you the Micro and Macro market conditions.

First things first, it is more than obvious to see the amount of new listings dropped SUBSTANTIALLY this year compared to the amount of sales recorded. Without going into Inventory too much, as we did that blog recently (click here to view), Inventory still is playing quite a toll on the market. Now add this to the shear increase in sales across most sections, it’s no wonder the market increased 42.4% overall since last January.

An important note before we all get carried away, we are still below the 10-Year average by 7.3%. As you regular readers know, we are not fans of the ‘10 year average’ comparison, but it’s a good metric to keep yourself grounded in this time for all you extreme optimists out there.

Pricing remained steady this month with an increase of 0.8% across the board. Although not too much, since October the average price increase for the months has creeped up from 0.6% to 0.8%.

The Sales to Active listings ratio is currently sitting at 18.2% which puts us in the balanced territory overall, however townhouses and condos still remain individually above 20%. With townhomes sitting at 22.6% and condos 23.9%. Interestingly enough houses dipped too 11.6% which means more pressure on house prices IF, and I cannot stress the IF there, this continues to decrease under the 12% mark. Typically 12% and under for a sustained period puts pressure on prices to drop, with ratios of 20% and over doing the opposite.

A very important note on price!

Yes it’s true the market is creeping slowly back up, 0.6%, 0.7% and so on so forth, however with the minimal price increases, we are still below where we were this time last year. Down 1.2% in fact. So, if you are sitting pretty, hoping prices are back on the rise, and that you are going to skyrocket your home price, you are mistaken. At this pace it will be another 2 months until you are at least breaking even with home prices this time last year, let alone beating them. Remember, if the value of your home decreases 5% and then the market rebounds 5%, you are breaking even, not gaining. There is still time to go before this turn around starts putting a lot of people in the positive.

As we’ve discussed many times, the sweet spot is really pricing accurately in this market and there is an abundance of proof for this. It still remains not doing so will have you sitting on the market and building up your DOM. It does not mean it will just take you 6 months or a year to sell at a higher price, the market is showing us buyers will just fein interest and move on to be options.

We hope this helps as always and thank you for tuning in! Feel free to reach out to us if you have any market specific questions! And with that, we are done for this week!

Until next week,

Let’s jump straight into the good stuff hey?!

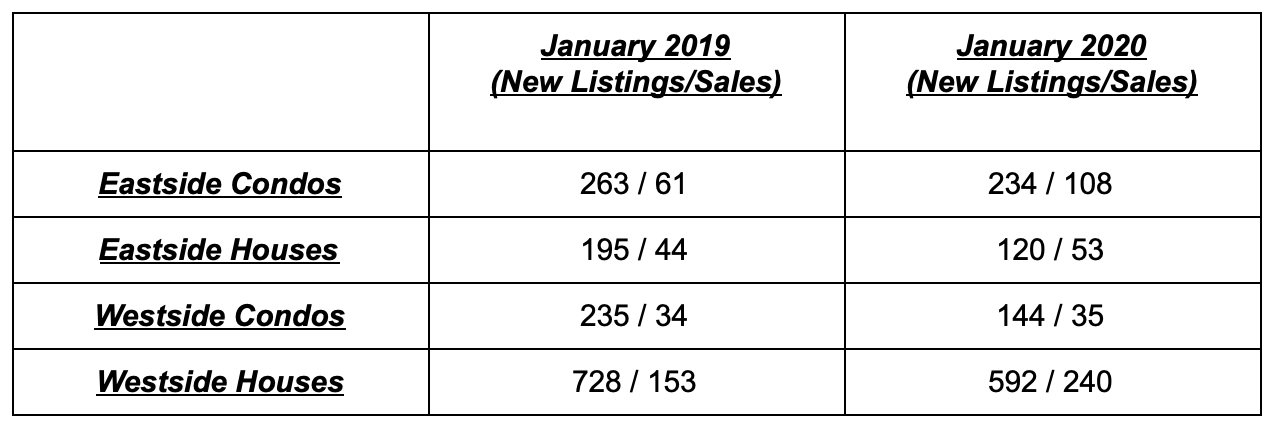

Above are the January 2019 vs January 2020 numbers when discussing ‘New Listings’ to the market and number of recorded ‘Sales’. These are specific to Vancouver’s East and West side mind you, however we have some additional holistic comparisons below as well in the hopes to show you the Micro and Macro market conditions.

First things first, it is more than obvious to see the amount of new listings dropped SUBSTANTIALLY this year compared to the amount of sales recorded. Without going into Inventory too much, as we did that blog recently (click here to view), Inventory still is playing quite a toll on the market. Now add this to the shear increase in sales across most sections, it’s no wonder the market increased 42.4% overall since last January.

An important note before we all get carried away, we are still below the 10-Year average by 7.3%. As you regular readers know, we are not fans of the ‘10 year average’ comparison, but it’s a good metric to keep yourself grounded in this time for all you extreme optimists out there.

Pricing remained steady this month with an increase of 0.8% across the board. Although not too much, since October the average price increase for the months has creeped up from 0.6% to 0.8%.

The Sales to Active listings ratio is currently sitting at 18.2% which puts us in the balanced territory overall, however townhouses and condos still remain individually above 20%. With townhomes sitting at 22.6% and condos 23.9%. Interestingly enough houses dipped too 11.6% which means more pressure on house prices IF, and I cannot stress the IF there, this continues to decrease under the 12% mark. Typically 12% and under for a sustained period puts pressure on prices to drop, with ratios of 20% and over doing the opposite.

A very important note on price!

Yes it’s true the market is creeping slowly back up, 0.6%, 0.7% and so on so forth, however with the minimal price increases, we are still below where we were this time last year. Down 1.2% in fact. So, if you are sitting pretty, hoping prices are back on the rise, and that you are going to skyrocket your home price, you are mistaken. At this pace it will be another 2 months until you are at least breaking even with home prices this time last year, let alone beating them. Remember, if the value of your home decreases 5% and then the market rebounds 5%, you are breaking even, not gaining. There is still time to go before this turn around starts putting a lot of people in the positive.

As we’ve discussed many times, the sweet spot is really pricing accurately in this market and there is an abundance of proof for this. It still remains not doing so will have you sitting on the market and building up your DOM. It does not mean it will just take you 6 months or a year to sell at a higher price, the market is showing us buyers will just fein interest and move on to be options.

We hope this helps as always and thank you for tuning in! Feel free to reach out to us if you have any market specific questions! And with that, we are done for this week!

Until next week,

Jay Mcinnes

T: 604.771.4606

jay@mcinnesmarketing.com

Ben Robinson

T: 604.353.8523

ben@mcinnesmarketing.com