August 2020 - Vancouver Real Estate Update

Pretty darn good to be frank. Our market has been consistently recovering from the pandemic, on top of this July was where the market turned around last year and started to get hot, we even managed to blow that out this year and achieve way above 10-year averages in sales. So did we follow suit in August, and is there a BUT moment we need to be aware of. The answer is yes, to both.

Listing inventory was down year over year by 4.4%. So just absorb that for a minute, we are up by 37% for sales activity this year, yet we are dealing with almost 5% less properties on the market. Back in March/April, we called what would happen with our market, based upon buyer demand keeping up, or exceeding, inventory levels.

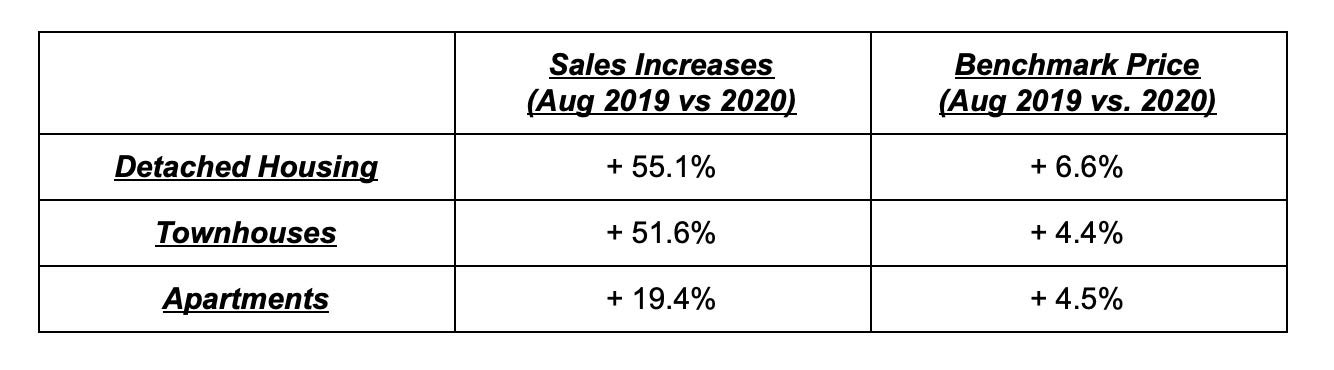

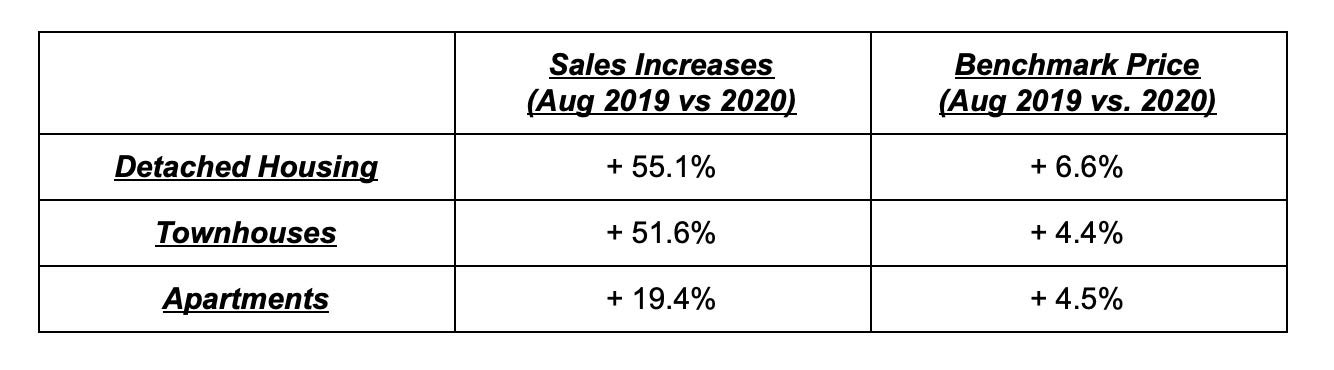

All property types outperformed their 2019 numbers. Take a look at the below, showing how much of an increase year over year, for each property type we saw in August.

These are no joke numbers here. Significantly higher year-over-year. Benchmark pricing has increased anywhere from 0.5% - 1.1% since July 2020 too. Once again, month-to-month is more short term looking, but you can see the numbers are tracking upwards here, not down, whether your look at the short or long term trajectory.

BUT ….

Here it is, the infamous but …

These numbers are based on Greater Vancouver. Not every market performs this way. For example, Maple Ridge will not perform in the same way as Downtown Vancouver.

If you’re selling your 2 bedroom, 2 Bathroom apartment in Vancouver right now, you will notice it’s not as hot as the above market is making out. It’s actually going through a bit of a lull, and that needs to be addressed. Truth is, we are still navigating through this Covid-19 era, some people are comfortable, others are not, some were comfortable and are now scared again. It’s not a back to normal market, pre covid, where everything is flying off the shelf again. A lot of areas are taking time, with buyers moving slower and doing their due-diligence. Sellers still have to be very on the ball to achieve success in these areas.

But what about unemployment rates and mortgage deferrals coming to an end?!

Now here we are, at the hot topic of the nay-sayers. But let’s really take a look at this, starting with unemployment rates.

StatCan states unemployment rates have been getting better and better since May, at its peak of 13.7%. In August this number sits at 10.2%. On top of the trending downwards, it seems to be those who are actually in a position to buy are the ones who are back at work and not a part of that 10.2% number. To put it bluntly, the minimum wage, lower paid jobs, and people who were not in a position to buy before Covid-19 hit, are typically what’s making up that 10.2% number to date. Therefore, not taking away from the actual Buyers pool.

Now onto mortgage deferrals. In all of BC, only 7-11% of people have deferred their mortgages, let that sink in, that’s ALL of BC, not just Greater Vancouver. Furthermore, when these deferrals stop, it doesn’t mean that ALL of them will need to sell. That’s such a small amount of people deferring mortgages, not anywhere near enough to cause our market to fly off the cliff. Especially when you look at Alberta deferring 21% of their mortgages.

So in summary, is the overall market trending in the right direction? Absolutely, and we are recovering strong. Buyers, it’s still your chance to act, Sellers, you MUST be flexible to succeed in this market if you are not in one of the hotspots right now. You need to listen to what the market is telling you to succeed.

As always, thanks for reading, watching or listening. We’ll see you next week!

Until then,

In a flash, we are done with Summer and start to turn our eyes towards Fall. Typically a season filled with joyful events such as Halloween, Thanksgiving, Pumpkin Spice Lattes …… And busier real estate! So how exactly are we gearing up for the fall as we leave summer's warm embrace?

Pretty darn good to be frank. Our market has been consistently recovering from the pandemic, on top of this July was where the market turned around last year and started to get hot, we even managed to blow that out this year and achieve way above 10-year averages in sales. So did we follow suit in August, and is there a BUT moment we need to be aware of. The answer is yes, to both.

- Our most hated statistic of them all - The 10 Year Sales Average, was blown out of the water. Vancouver saw sales achieve levels 19.9% ABOVE the ten year average.

- When we compare August 2019 vs. August 2020, we blew past last year's sales figures too, by 36.6% to be exact!

- The August 2020 Sales-to-active listings ratio was 23.8%. That’s three months consistently above the 20% threshold which signifies a ‘sellers market’ traditionally.

Listing inventory was down year over year by 4.4%. So just absorb that for a minute, we are up by 37% for sales activity this year, yet we are dealing with almost 5% less properties on the market. Back in March/April, we called what would happen with our market, based upon buyer demand keeping up, or exceeding, inventory levels.

All property types outperformed their 2019 numbers. Take a look at the below, showing how much of an increase year over year, for each property type we saw in August.

These are no joke numbers here. Significantly higher year-over-year. Benchmark pricing has increased anywhere from 0.5% - 1.1% since July 2020 too. Once again, month-to-month is more short term looking, but you can see the numbers are tracking upwards here, not down, whether your look at the short or long term trajectory.

BUT ….

Here it is, the infamous but …

These numbers are based on Greater Vancouver. Not every market performs this way. For example, Maple Ridge will not perform in the same way as Downtown Vancouver.

If you’re selling your 2 bedroom, 2 Bathroom apartment in Vancouver right now, you will notice it’s not as hot as the above market is making out. It’s actually going through a bit of a lull, and that needs to be addressed. Truth is, we are still navigating through this Covid-19 era, some people are comfortable, others are not, some were comfortable and are now scared again. It’s not a back to normal market, pre covid, where everything is flying off the shelf again. A lot of areas are taking time, with buyers moving slower and doing their due-diligence. Sellers still have to be very on the ball to achieve success in these areas.

But what about unemployment rates and mortgage deferrals coming to an end?!

Now here we are, at the hot topic of the nay-sayers. But let’s really take a look at this, starting with unemployment rates.

StatCan states unemployment rates have been getting better and better since May, at its peak of 13.7%. In August this number sits at 10.2%. On top of the trending downwards, it seems to be those who are actually in a position to buy are the ones who are back at work and not a part of that 10.2% number. To put it bluntly, the minimum wage, lower paid jobs, and people who were not in a position to buy before Covid-19 hit, are typically what’s making up that 10.2% number to date. Therefore, not taking away from the actual Buyers pool.

Now onto mortgage deferrals. In all of BC, only 7-11% of people have deferred their mortgages, let that sink in, that’s ALL of BC, not just Greater Vancouver. Furthermore, when these deferrals stop, it doesn’t mean that ALL of them will need to sell. That’s such a small amount of people deferring mortgages, not anywhere near enough to cause our market to fly off the cliff. Especially when you look at Alberta deferring 21% of their mortgages.

So in summary, is the overall market trending in the right direction? Absolutely, and we are recovering strong. Buyers, it’s still your chance to act, Sellers, you MUST be flexible to succeed in this market if you are not in one of the hotspots right now. You need to listen to what the market is telling you to succeed.

As always, thanks for reading, watching or listening. We’ll see you next week!

Until then,

Jay Mcinnes

T: 604.771.4606

jay@mcinnesmarketing.com

Ben Robinson

T: 604.353.8523

ben@mcinnesmarketing.com